Mistakes to avoid in life insurance for seniors over 80 include choosing expensive whole life over affordable final expense – costing thousands extra. Nearly 60% of Americans over 80 lack adequate coverage, and those who have policies often overpay by 40-70% due to preventable errors.

Life insurance for seniors over 80 provides financial protection for funeral costs, medical bills, and final expenses. Unlike traditional policies requiring medical exams, options like final expense insurance and guaranteed issue life insurance offer simplified approval for older applicants with health conditions.

As a blogger reviewing senior insurance, I’ve seen countless mistakes to avoid in life insurance for seniors over 80. Reader Margaret discovered her 83-year-old mother paid $215 monthly for whole life when final expense insurancewould cost just $89 – saving over $15,000 across ten years. These common life insurance mistakes seniors 80+ make inspired this guide.

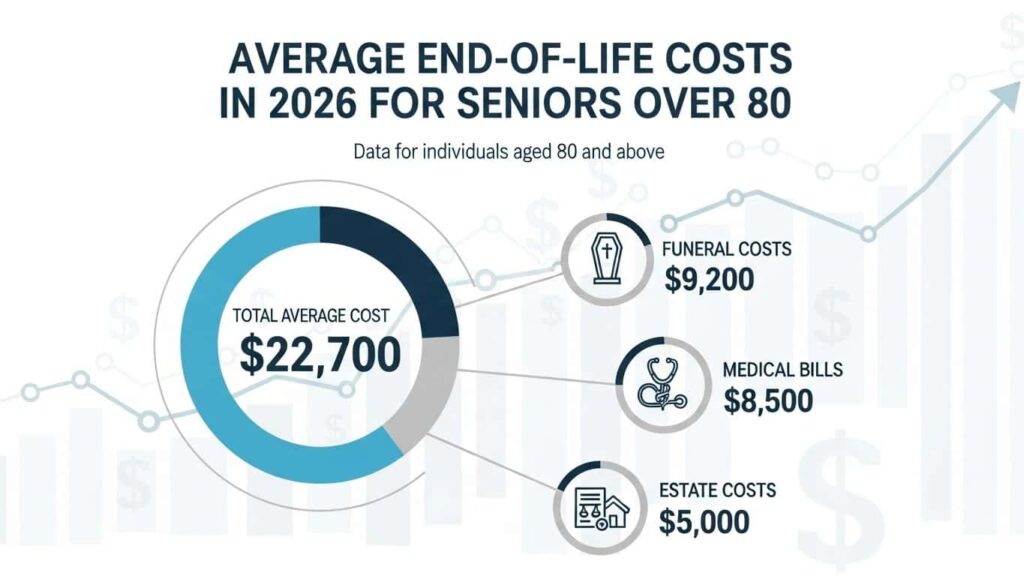

With funeral costs exceeding $9,000 in 2026, avoiding policy mistakes seniors make isn’t just about saving money – it’s ensuring dignity without burdening families.

Table of Contents

Why Life Insurance for Seniors Over 80 Matters

Life insurance for seniors over 80 addresses burial insurance seniors need, medical debts, and final expenses. Without coverage, families face $7,000-$15,000 in immediate funeral costs, plus estate settlement expenses totaling $25,000 or more.

Coverage Amounts vs. Monthly Costs (2026)

| Coverage Amount | Guaranteed Issue (Age 82) | Final Expense (Age 82) | Whole Life (Age 82) |

|---|---|---|---|

| $10,000 | $85-$125/month | $72-$98/month | $185-$275/month |

| $15,000 | $125-$185/month | $105-$142/month | $275-$410/month |

| $25,000 | $205-$305/month | $172-$235/month | $455-$680/month |

According to AARP’s 2025 study, “Seniors purchasing final expense insurance designed for their age save 35% compared to traditional whole life while receiving better-suited coverage.” Most seniors over 80 need $10,000-$25,000, not the inflated amounts creating premium traps elderly buyers face.

Top 10 Mistakes to Avoid in Life Insurance for Seniors Over 80

1. Choosing Whole Life Over Final Expense Insurance

The costliest mistakes to avoid in life insurance for seniors over 80 is buying traditional whole life when final expense insurance serves better. Whole life costs 50-100% more because of cash value features providing minimal benefit at advanced ages.

Example: Robert, 81, paid $385/month for $20,000 whole life. He switched to final expense insurance at $168/month – saving $2,604 annually.

Avoidance Tip: For coverage under $50,000, always compare final expense insurance first to avoid these mistakes to avoid in life insurance for seniors over 80.

2. Ignoring Graded Death Benefit Waiting Periods

Many seniors over 80 buy guaranteed issue life insurance without understanding graded death benefits. These policies have 2-3 year waiting periods seniors face where natural death pays only premiums plus 10% interest, not full benefits – creating devastating coverage gaps over 80.

In 2026, 40% of guaranteed issue life insurance buyers don’t fully grasp waiting periods seniors encounter, per the National Association of Insurance Commissioners.

Reader Experience: Joyce’s 84-year-old father passed 18 months into his policy. Instead of $12,000, the family received $2,700 – just premiums paid. Understanding waiting periods seniors face is critical among mistakes to avoid in life insurance for seniors over 80.

Avoidance Tip: Ask specifically about graded death benefits and waiting periods seniors face. If you have minor health issues, no-exam life insurance simplified issue often provides immediate coverage at competitive rates.

3. Failing to Update Beneficiaries

Beneficiary errors cause heartbreaking mistakes to avoid in life insurance for seniors over 80, resulting in benefits paid to ex-spouses or deceased individuals. These beneficiary errors increased 23% among seniors over 80 in 2025, delaying payments 6-18 months.

Avoidance Tip: Review beneficiaries annually. Name primary and contingent beneficiaries. Reference our beneficiary considerations guide to prevent beneficiary errors.

4. Paying Monthly Instead of Annually

Monthly payments add 8-15% in fees – one of the hidden premium traps elderly buyers encounter. A $10,000 final expense insurance policy costs $936 annually or $1,044 with monthly payments ($108 difference, $1,080 over ten years).

Avoidance Tip: Choose annual payments when feasible to avoid premium traps elderly face with life insurance for seniors over 80.

5. Not Comparing Multiple Quotes

Premium variations exceed 40% between companies for identical life insurance for seniors over 80, yet 65% of seniors over 80 get only 1-2 quotes before buying.

Blogger Experience: I compared quotes for an 83-year-old seeking $15,000 final expense insurance. Quotes ranged $112-$188 monthly – a $912 annual difference. Not comparing is among the most preventable mistakes to avoid in life insurance for seniors over 80.

Avoidance Tip: Get 3-5 quotes using tools like Policygenius. See our comparing quotes guide for strategies.

6. Buying Insufficient Coverage

Underinsurance creates coverage gaps over 80. Many seniors over 80 buy $5,000-$7,000 policies insufficient for actual costs.

CBS News reported: “Average funeral costs now exceed $9,000 nationally, reaching $12,000-$15,000 in urban areas – yet many seniors over 80 carry policies under $7,500.”

Actual Costs:

- Funeral service: $2,500-$4,000

- Casket: $2,000-$10,000

- Burial plot: $1,000-$4,000

- Headstone: $1,000-$3,000

- Additional services: $1,500-$3,000

- Total: $8,000-$24,000

Avoidance Tip: Calculate local costs and add 15-20% for inflation to prevent coverage gaps over 80.

7. Hiding or Exaggerating Health Conditions

Application dishonesty creates policy mistakes seniors make. Undisclosed conditions void policies during contestability periods, while exaggerating increases premiums unnecessarily.

For seniors over 80 with serious conditions, guaranteed issue life insurance accepts everyone – dishonesty is unnecessary. For minor conditions, no-exam life insurance simplified issue offers better rates.

Avoidance Tip: Answer honestly. See our pre-existing conditions guide for options.

8. Overlooking Existing Coverage

Some seniors over 80 buy new life insurance for seniors over 80 while holding adequate employer, veterans, or paid-up policies – wasteful policy mistakes seniors make.

Check for:

- Employer retiree benefits

- VA burial insurance seniors benefits ($2,000-$9,000)

- Forgotten existing policies

- Mortgage insurance death benefits

Avoidance Tip: Review existing coverage before purchasing new life insurance for seniors over 80.

9. Ignoring State Burial Programs

Many states offer burial insurance seniors assistance ($1,000-$5,000 for low-income individuals), potentially eliminating private insurance needs.

Avoidance Tip: Research state insurance department websites for assistance programs before buying private life insurance for seniors over 80.

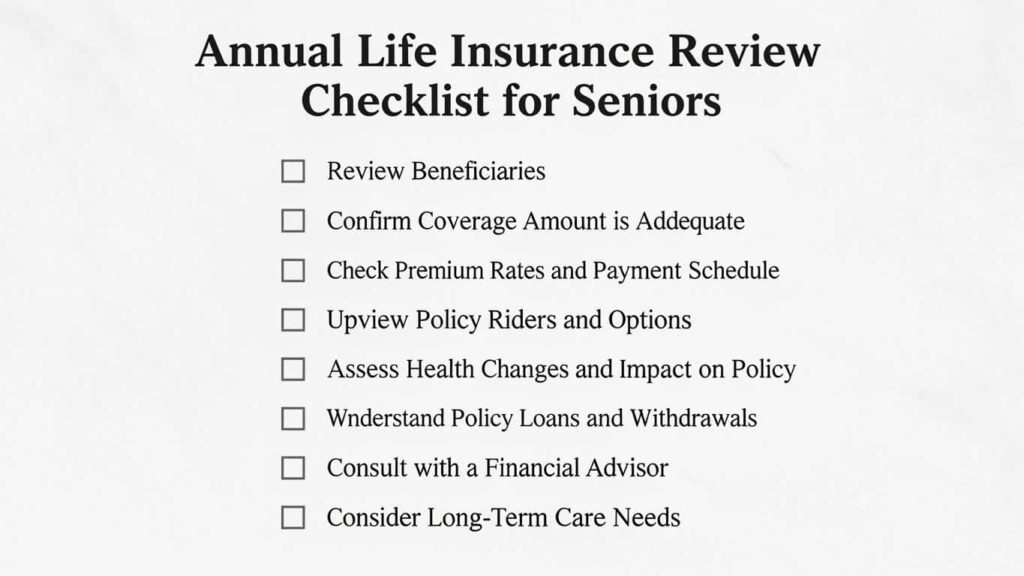

10. Neglecting Annual Policy Reviews

Life insurance for seniors over 80 requires annual reviews. Rates change, products improve, and situations shift – yet most seniors over 80 never review after purchase.

Review annually:

- Coverage amount adequacy

- Better available rates

- Beneficiary accuracy (prevent beneficiary errors)

- Payment method efficiency

- Company stability

Avoidance Tip: Calendar annual reviews to catch policy mistakes seniors make early.

Policy Comparison for Life Insurance for Seniors Over 80

Policy Type Comparison (2026)

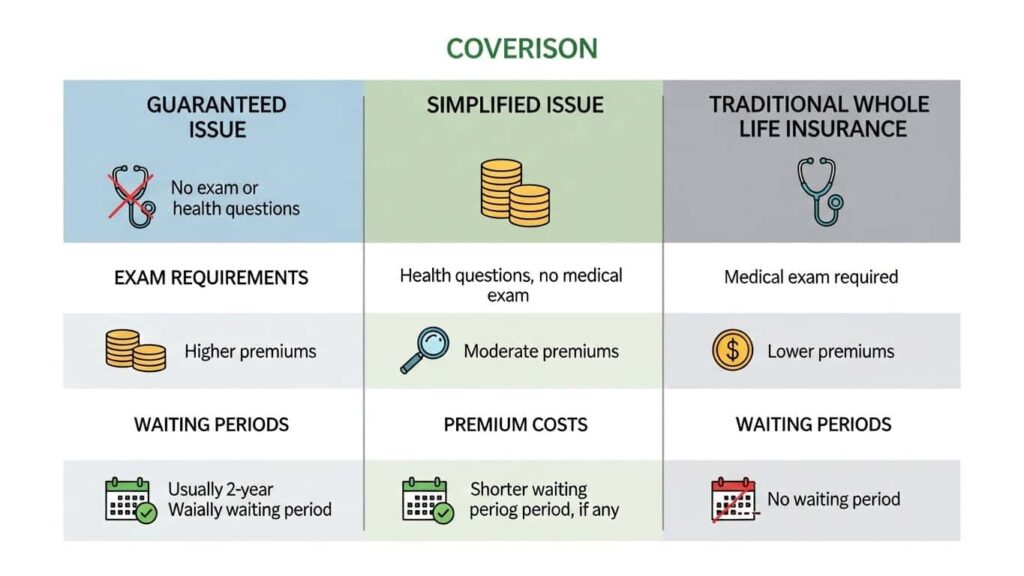

| Feature | Guaranteed Issue | Simplified Issue | Traditional Whole Life |

|---|---|---|---|

| Medical Exam | None | None | Required |

| Health Questions | None | 5-10 basic | Extensive |

| Approval Time | 24-48 hours | 2-7 days | 4-8 weeks |

| Waiting Period | 2-3 years | Usually none | None |

| Premium (Age 82, $10K) | $105-$145 | $72-$98 | $185-$275 |

| Coverage Limits | $5K-$25K | $5K-$50K | $10K-$100K+ |

| Best For | Serious health issues | Minor conditions | Excellent health |

Choosing the Right Policy Type

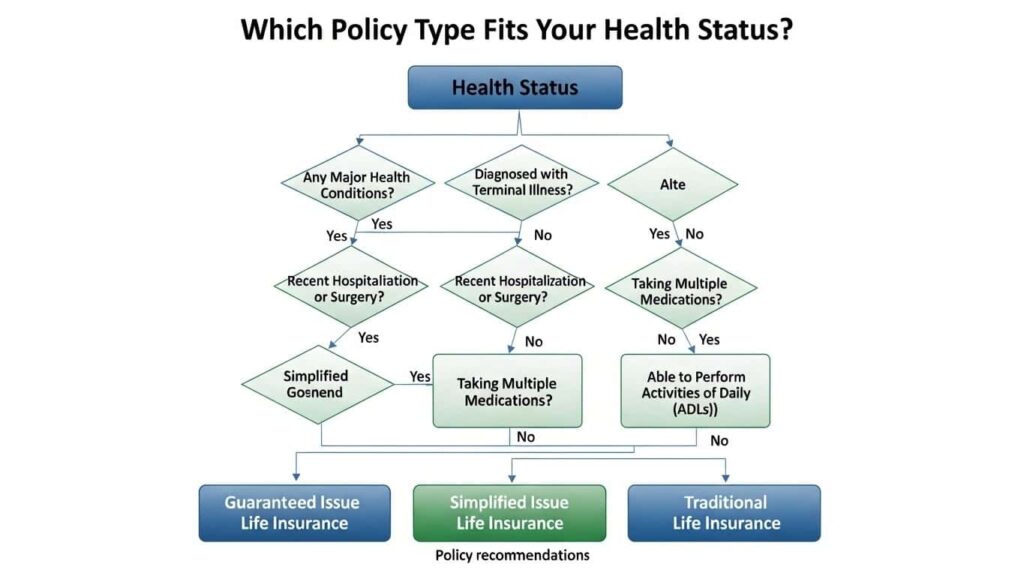

Choose Guaranteed Issue Life Insurance if:

- You have serious health conditions

- You’ve been denied elsewhere

- You accept waiting periods seniors face for guaranteed approval

Choose Simplified Issue Final Expense if:

- You have minor health issues

- You want immediate coverage without waiting periods seniors face

- You need $10,000-$25,000 coverage

- You want best cost-coverage balance in life insurance for seniors over 80

Choose Traditional Whole Life if:

- You’re in excellent health

- You need larger amounts

- Estate planning is priority

Use Policygenius for personalized quotes comparing all three life insurance for seniors over 80 types. See our best companies guide for top-rated options.

Expert Insights on Mistakes to Avoid

AARP Insurance Director (2025): “The biggest mistake is seniors over 80 buying based on fear. Many purchase expensive life insurance for seniors over 80 through high-pressure tactics. These policy mistakes seniors make are preventable by comparing options with trusted family.”

CBS News (December 2025): “Seniors over 80 shopping with three+ insurers save $1,200 annually versus buying from the first agent. The competitive life insurance for seniors over 80 market rewards comparison shopping.”

NAIC Consumer Guide (2026): “Guaranteed issue life insurance serves seniors over 80 with serious conditions, but waiting periods seniors face with graded death benefits must be understood. Family surprises about reduced claims are common mistakes to avoid in life insurance for seniors over 80.”

Real Senior Stories

Margaret’s Save: “Mom paid $215 monthly for whole life bought at 75. Final expense insurance offered identical $15,000 coverage for $89/month – saving $1,512 yearly. Not comparing earlier was costly.”

Thomas’s Warning: “Dad died 18 months into guaranteed issue life insurance. We expected $10,000 but received $2,700 – just premiums paid. Understanding graded death benefits and waiting periods seniors face is crucial among mistakes to avoid in life insurance for seniors over 80.”

Elizabeth’s Success: “Despite diabetes, I qualified for no-exam life insurance at $94/month versus $167 for guaranteed issue life insurance. Shopping saved $876 yearly with immediate coverage without waiting periods seniors typically face.”

Step-by-Step Guide to Buying Right

Step 1: Assess Needs

- Calculate funeral costs in your area

- List outstanding debts

- Determine legacy amounts

- Target: $10,000-$25,000 for most seniors over 80

Step 2: Check Existing Coverage

- Employer retiree benefits

- Veterans burial insurance seniors benefits

- Existing policies

- Pre-paid funeral plans

Step 3: Evaluate Health

- Current conditions

- Recent hospitalizations

- Medications

- Determines if you need guaranteed issue, simplified issue, or traditional

Step 4: Compare Quotes

- Get 3-5 quotes for life insurance for seniors over 80

- Use Policygenius

- Compare identical amounts

- Check company ratings

Step 5: Read Fine Print

- Ask about waiting periods seniors face

- Understand graded death benefits

- Verify premium guarantees

- Review exclusions

Step 6: Update Beneficiaries

- Name specific individuals

- Include contingent beneficiaries

- Update for life changes

- Prevent beneficiary errors

Step 7: Choose Payment Method

- Select annual if feasible (saves 8-15%)

- Avoid premium traps elderly encounter

- Set automatic payments

Step 8: Document Everything

- Store policy accessibly

- Inform beneficiaries

- Share with executor

- Keep contact information current

Step 9: Schedule Annual Reviews

- Review coverage adequacy

- Check for better rates

- Verify beneficiaries

- Prevent policy mistakes seniors make

Frequently Asked Questions

Can you get life insurance for seniors over 80 at age 85?

Yes. Guaranteed issue life insurance accepts seniors over 80 to age 85-89 with no medical questions. These no-exam life insurance policies offer $5,000-$25,000 with waiting periods seniors must understand. Final expense insurancesimplified issue also accepts to age 85. Premiums are higher, but burial insurance seniors need remains accessible.

What’s the average cost of life insurance for seniors over 80?

Seniors over 80 pay $85-$125 monthly for $10,000 guaranteed issue life insurance, or $72-$98 for final expense insurance simplified issue. Traditional whole life costs $185-$275 monthly – a premium trap elderly should avoid. Use comparison tools to find best rates.

Is final expense insurance worth it for seniors over 80?

Yes, if you lack $15,000+ savings for funeral costs. Final expense insurance ($75-$120 monthly for $10,000-$15,000) prevents coverage gaps over 80 and family burden. With funerals exceeding $9,000 in 2026, it’s valuable protection.

What happens during waiting periods with graded death benefits?

During graded death benefits waiting periods seniors face (2-3 years), natural death pays only premiums plus 10% interest. Accidental death pays full benefits. After waiting periods end, all deaths receive full benefits – critical to understand with guaranteed issue life insurance.

Can I get coverage with diabetes or heart disease?

Yes. Guaranteed issue life insurance accepts all seniors over 80 regardless of health – no questions asked. These no-exam life insurance policies include waiting periods seniors face but guarantee approval. Well-managed conditions might qualify for no-exam life insurance simplified issue with better rates and no waiting periods seniors encounter.

How do I avoid being denied?

Choose guaranteed issue life insurance for serious conditions – cannot deny. For simplified issue: apply when stable, answer honestly, organize records, use specialized agents, compare insurers. These strategies prevent mistakes to avoid in life insurance for seniors over 80.

What’s the difference between burial insurance and life insurance for seniors over 80?

Burial insurance seniors receive is small permanent coverage ($5,000-$25,000) for funeral costs – same as final expense insurance. Life insurance for seniors over 80 encompasses all types including burial insurance seniors need, guaranteed issue life insurance, no-exam life insurance, and traditional whole life.

Should I cancel old whole life for final expense insurance?

Not automatically – this could be policy mistakes seniors make. Check old policy’s value, cash value, and rates first. Request in-force illustration. Consider health, costs, surrender charges. Often keeping and supplementing beats replacing. Consult advisors before canceling life insurance for seniors over 80.

Conclusion

Avoiding mistakes to avoid in life insurance for seniors over 80 saves thousands while protecting families. Key takeaways: compare quotes, understand waiting periods seniors face with graded death benefits, choose right policy type (guaranteed issue life insurance, final expense insurance, or traditional), update beneficiaries to prevent beneficiary errors, and review annually to avoid premium traps elderly encounter and coverage gaps over 80.

Life insurance for seniors over 80 provides dignity and relieves burden through proper burial insurance seniorsreceive. With funeral costs exceeding $9,000, having $10,000-$25,000 coverage ensures final wishes are honored without family hardship.

Take Action:

Use free Policygenius to compare guaranteed issue life insurance, final expense insurance, and no-exam life insurance options without obligation.

Additional Resources:

Don’t let confusion prevent protection. Avoiding common life insurance mistakes seniors 80+ make starts with education. Compare quotes free via Policygenius today.

Guide on mistakes to avoid in life insurance for seniors over 80 updated January 2026. Consult licensed professionals for personalized guidance on guaranteed issue life insurance, final expense insurance, and no-exam life insurance.